12 Sep 2022

12 Sep 2022“COVID-19 has changed the structure of many small-businesses across the economy. Many are adopting new strategies and technologies to survive in the current market scenario.”

The COVID-19 pandemic has created financial desolation globally, leaving small business owners hopeless and hapless. As per the reports of National Federation of Independent Business (NFIB), around 92% of small businesses suffered badly because of the pandemic.

Though the definition of recovery varies for every small business, it is important to consider how the recovery mode will look like for businesses across industries once the economy lands on track. Hence, it is essential to have an exit strategy in place that will help you to effectively manage the crisis of COVID-19.

Indeed, recovery is a time-consuming process, and every organization will recover at its own pace. But the current economic vulnerability generated by COVID-19 pandemic will likely make recovery an impossible task for some small level businesses. How to save my failing business?, has become a persistent thought of many business owners.

Most common hurdles that every business is supposed to encounter on their recovery journey are staffing, supply chain, material cost, customer service, and cash flow.

Many small businesses may have to change the flow of their business in order to survive. They need to adopt crucial practices to keep themselves afloat in the market. In this blog, we have discussed in detail important practices of rebuilding your small business post COVID-19.

Before developing COVID-19 recovery plan it is essential to understand the needs of the business and determine how deeply your business has been affected.

Update your financial statements-such as profit and loss or cash flow statements to gain a clear picture of your business's numbers. Compare last years number to current years numbers and then examine where you are lacking.

Apart from considering numbers relating to sales, cash flow and profits, consider other factors as well which play a significant role in hampering the growth of your business. For instance, you may not be able to afford all of your employees so lay off may be the solution that you need to consider in your rebuilding plan. If you want to recover your financial resources, then it is wise of you to cut your advertising and marketing budget down.

Your business model may perfectly suit the pre-COVID-19 marketplace, but the market realm has changed completely post pandemic, which means you have to mold your business as per current market scenario.

Being a small business owner, you specifically have to decipher a solution through which your business can adjust to new normal. For instance, if your brick-and-mortar location drives you sales then it is time for you to consider digital expansion.

Studying the effect of the coronavirus pandemic on your overall industry can also give you insightful information. Closely look at the activities of your competitors and the industry as a whole and focus on finding new opportunities. If you are able to fill a gap that has been prevailing in your industry since ages, then you can easily reclaim and expand your customer base.

Understanding businesss strengths and weaknesses is important since it will help in business growth and redefining the business model. Then, examine what was working for you before the corona era that may not work or may require improvement post pandemic.

It is not easy to jump start business operations unless you dont have enough working capital. Financing a small business during COVID-19 is not as easy as it seems. Small business owners may find several programs that can help, for instance, Paycheck Protection Program is created to help small businesses that are struggling to retain their employees during the pandemic. Economic Injury Disaster Loans also support short-term financing in case you require money for things other than employee retention.

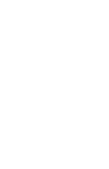

However, both of these programs provide limited funding to the organization. In addition, it may be possible that your funding may be reduced even before your loan application is reviewed. Hence, it is important to examine other important source of funding as well and these sources are:

Those businesses who have survived the COVID-19 pandemic may need to invest huge in their business before they can make money out of it. For example, businesses may need to indulge in the hiring and training process again, rev up their advertising budget to create a fresh buzz in the market.

Budgeting is a significant factor in the coronavirus recovery journey. But before you draft your budget get a clear idea of your business needs and what you can cut to make the most of the revenue. The purpose of having a budget plan is to eliminate unnecessary monetary waste and get your operating budget as smooth as possible.

As an entrepreneur you may want to recover everything at once but it does not seem realistic. A timeline that describes your priorities can motivate you to work on your most important actions first.

For instance, your immediate goal is to secure funding for your business, once you have achieved this goal you set your actions to accomplish other goals such as rehiring employees, restocking inventory and many more.

As you move ahead in your recovery journey, you need to learn how to take advantage of pandemic and likewise remember to track your growth. This is specifically important if you have enough capital to support your business because you dont want to indulge in activities that are not generating any profit.

The global pandemic may seem like a once-in-a-lifetime event, but the reality is an emergency can knock on your door at any time. At that moment small businesses across the economy will require new technology and new business models to survive. The COVID-9 crisis has revealed financial frailties that have built over time, and the next normal could impose additional burdens. Businesses need strategies that they can adapt as per the current market challenge. They need to find a new operating model to accelerate their growth.

.jpg)

11 Jan 2019

11 Jan 2019